Aluminum pricing at your fingertips.

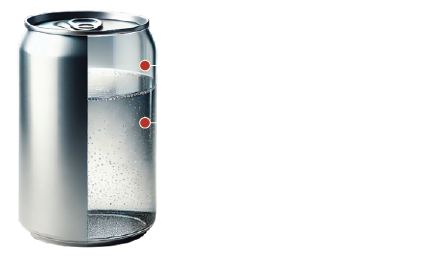

The cost of a can isn’t just about metal. Roughly one-third comes from aluminum itself, while two-thirds comes from non-metal inputs like logistics, coatings, and labor. By understanding the real drivers and market dynamics—you can anticipate changes, plan with confidence and protect your margins.

1/3 of can cost is aluminum, with the remainder derived from non-metal inputs.

Raw Aluminum Price Components:

-

London Metal Exchange (LME) Price: The global market value of raw aluminum set by the London Metal Exchange.

-

Midwest Premium (MWP) Price: A North American surcharge covering transport, storage, and supply costs.

Non-Metal Input Price: Everything else that goes into making and delivering a can—labor, coatings, logistics, and more.

Raw Aluminum Price

Aluminum Price / lb USD

What if your supplier was also your market insider?

Transparent market data is the foundation for smarter purchasing decisions. Our team can help you lock in stability, forecast with clarity, and turn responsiveness into a growth lever. Let's explore how good old-fashioned customer service can transform your supply chain.

The Shop Beer co.

When The Shop Beer Co. scaled its can supply strategy, transparency was the difference-maker. By tapping into Cask’s real-time aluminum market insights, they were able to plan their purchases, avoid cost spikes, and confidently grow their distribution footprint..